Understanding customer value through cohort analysis

When building a successful eCommerce business, one of the most critical questions you need to answer is: What is a customer worth? The answer isn't as straightforward as you might think, and getting it wrong can make or break your paid acquisition strategy.

Today, I want to walk you through the concept of "Revenue Cake" and show you how cohort analysis can unlock the true value of your customers—helping you make smarter decisions about how much to spend on acquisition and when to expect profitability.

The Two Components of Total Revenue

Most business owners think of revenue as one big number, but it's actually made up of two distinct components:

- New Customer Revenue - Money from people who haven't purchased from your business before

- Returning Customer Revenue - Money from customers making repeat purchases

Understanding this split is crucial because different business types have dramatically different revenue ratios.

Business Type Examples

Skincare Company: These businesses typically see a large proportion of returning customer revenue. When someone finishes their moisturizer, they're likely to come back and buy another. The products need to be replaced with use, creating natural repurchase cycles.

Bike Manufacturer: These businesses rely heavily on new customer revenue. A bike is a high-cost item that doesn't need frequent replacement, so returning customer revenue makes up a much smaller portion of total revenue.

This fundamental difference affects everything—from your marketing budget allocation to your customer acquisition cost (CAC) targets.

Enter Cohort Analysis: Your Revenue Crystal Ball

Cohort analysis is a powerful way to visualize how customers return to your business over time. It groups customers by when they first purchased (their "cohort") and tracks their behavior in subsequent periods.

Let me show you four different ways to analyze cohorts using a skincare company example.

Our Example: The Skincare Company

For this analysis, let's assume:

- Product: $30 bottles of moisturizer

- Usage cycle: Each bottle lasts 3 months on average

- Seasonality: Peak activity in summer months (more sun exposure = more skincare needs)

Method 1: Percentage-Based Cohort Analysis

The foundation of cohort analysis starts with tracking the percentage of customers who return in each subsequent period.

In our skincare example, you'd see:

- Month 0: 100% (initial purchase)

- Month 1: 5% return rate

- Month 2: 3% return rate

- Month 3: 15% return rate (bottle runs out!)

- Month 6: 12% return rate (second bottle runs out)

- Month 9: 10% return rate (third bottle cycle)

This pattern clearly shows the 3-month replacement cycle, with the highest return rates occurring when customers' bottles are empty.

Method 2: Dollar Value Cohort Analysis

Now we can assign actual dollar values to these percentages. Since we know each bottle costs $30:

- Month 1: 5% return rate = $1.50 in expected revenue per original customer

- Month 2: 3% return rate = $0.90 in expected revenue per original customer

- Month 3: 15% return rate = $4.50 in expected revenue per original customer

This transforms abstract percentages into concrete revenue expectations, making it easier to understand the financial impact of customer behavior.

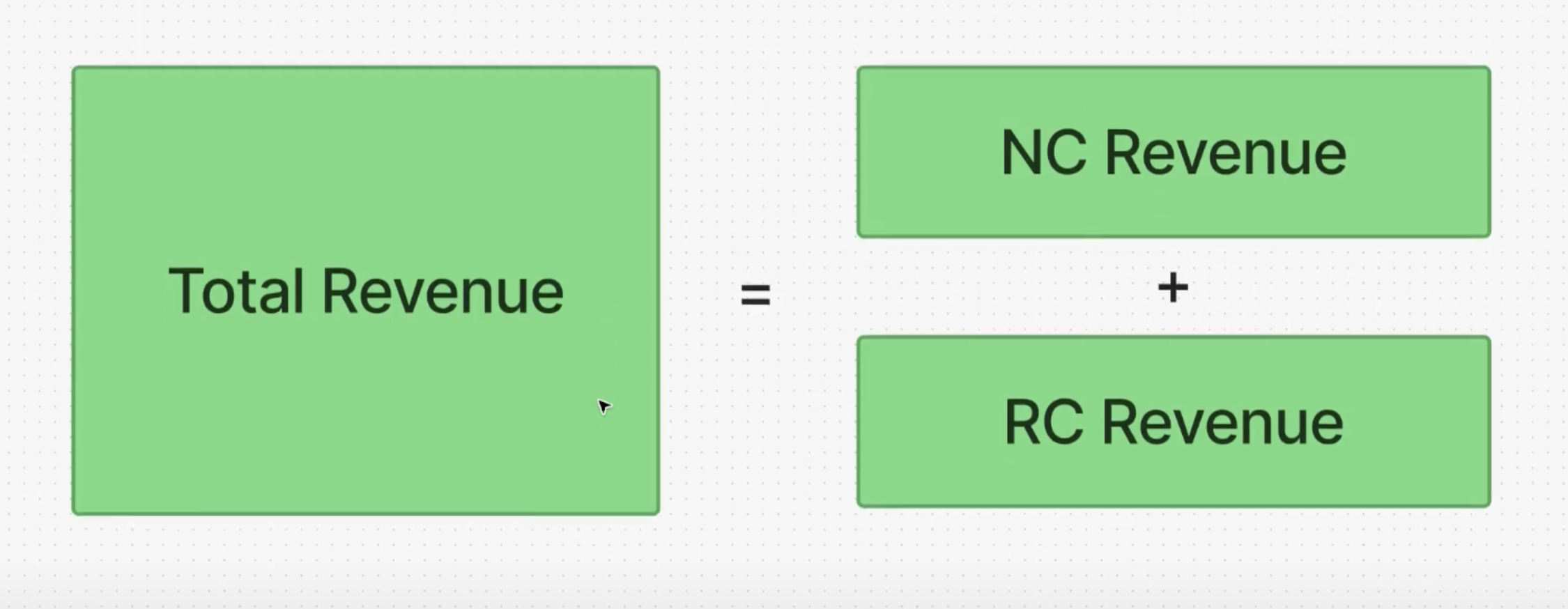

Method 3: Cumulative Revenue Analysis

This is where cohort analysis becomes truly powerful for acquisition strategy. Instead of looking at incremental revenue, we sum up the total expected value over time:

- Month 0: $30 (initial purchase)

- Month 3: $36 (initial + cumulative repeat purchases)

- Month 6: $42

- Month 9: $47

Key insight: Customers acquired in March (approaching summer) actually show higher cumulative values—$38 by month 3 instead of $36—due to increased seasonal activity.

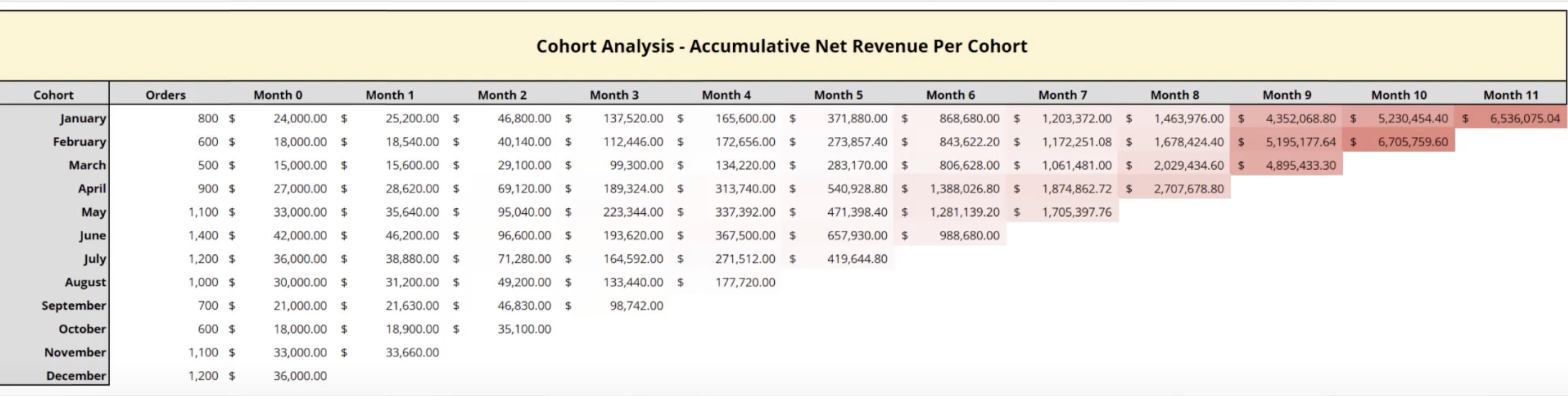

Method 4: Cohort Revenue Analysis

The final method looks at total revenue generated by entire customer cohorts, helping you understand which acquisition periods deliver the most long-term value.

The Critical Question: When Do You Want Profitability?

Armed with cohort data, you can now answer the fundamental question: What is one customer worth?

But this question requires a follow-up: When do you want to make back that value?

Scenario 1: Immediate Profitability

If you need to be profitable on the first purchase, you can only spend up to the Month 0 value minus your costs—around $30 in our example.

Scenario 2: Strategic Investment

If you're willing to invest in customer lifetime value, you might spend up to the Month 3 cumulative value—$36 in our example. This means taking a small loss upfront while banking on the high likelihood of repeat purchases.

For a skincare company with strong repeat purchase patterns, Scenario 2 often makes more sense. You're essentially investing in a customer relationship that will become increasingly profitable with each subsequent purchase.

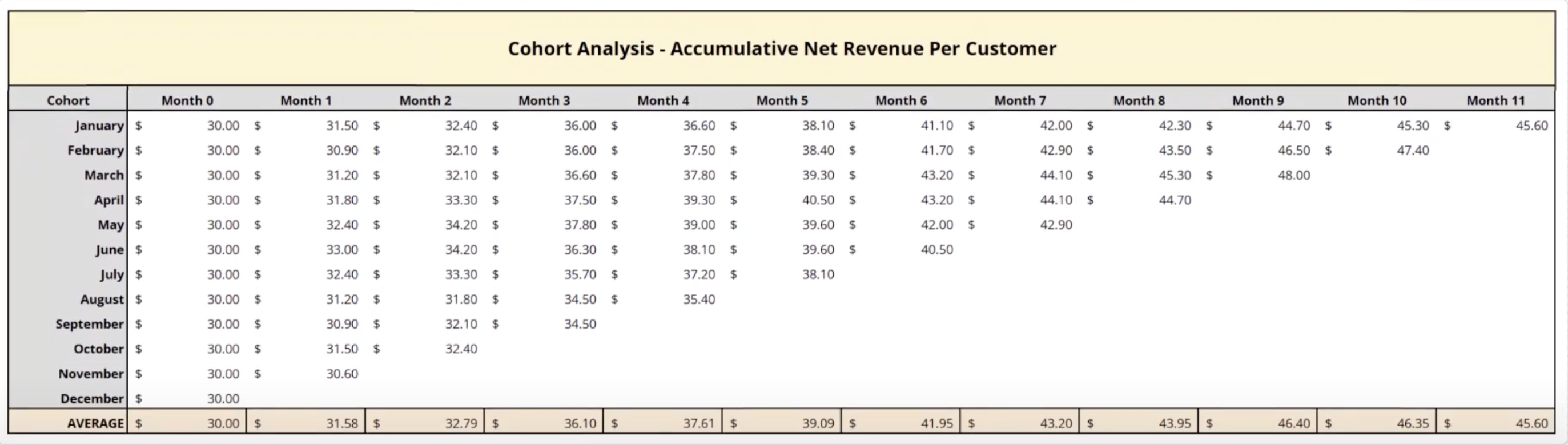

Applying This to Your Ad Strategy

This cohort analysis directly informs your paid acquisition approach:

High Repeat Purchase Businesses (Skincare, Supplements, Subscriptions)

- Consider longer payback periods (3-6 months)

- Can afford higher customer acquisition costs

- Focus on lifetime value optimization

- Every purchase after payback is pure profit margin expansion

Low Repeat Purchase Businesses (Bikes, Furniture, Electronics)

- Need immediate or very quick profitability

- Lower acceptable customer acquisition costs

- Focus on first-purchase optimization

- Limited opportunities for subsequent revenue

Seasonal Insights

Don't forget to factor in seasonality. In our skincare example, customers acquired in March showed 6% higher cumulative value by month 3 due to summer activity peaks. This might justify spending more on acquisition during certain times of the year.

Key Takeaways

- Know your revenue split: Understanding the ratio between new and returning customer revenue is fundamental to business strategy.

- Use cohort analysis: It's the most effective way to predict customer behavior and lifetime value.

- Match acquisition costs to business model: High-repeat businesses can afford longer payback periods; one-time purchase businesses cannot.

- Factor in seasonality: Customer value can vary significantly based on when they're acquired.

- Think beyond first purchase: For repeat-purchase businesses, every subsequent order improves unit economics without additional acquisition costs.

Getting Started

If you want to implement cohort analysis for your business:

- Export your customer purchase data

- Group customers by their first purchase month

- Track their subsequent purchase behavior

- Calculate percentage return rates and dollar values

- Build cumulative value projections

Understanding what a customer is truly worth—and when they'll deliver that value—is the foundation of sustainable, profitable growth. Master cohort analysis, and you'll have the insights needed to make smart acquisition investments that compound over time.

Need help implementing cohort analysis for your eCommerce business? Our team at Artifex Digital specializes in turning customer data into actionable growth strategies. Send us a message to learn more.

Check out our other articles.

Get started today.

We only work with a handful of clients per year. If you're interested, book a discovery with our founder to see if this is a good fit.

What we do

Grow & scale your paid media program with a boutique team of eCommerce advertising pros.

Case studies

See what we've done for other brands and how we can help you. Read their stories.